This page describes the functionality of approval and changes for payroll as an approver. An approver is responsible to verify the payroll calculations for the selected employees. It is important to take care of approval and changes for payroll as an approver. He/ She can approve the payroll for further processing or reject the payroll to send it back for correction.

Note: The option to Verify Payroll is not available in Empxtrack Free Payroll and HR software Trial. Clear Trial data and upgrade your product to avail this feature.

To verify and approve the payroll, you need to:

1. Log into the system as an Employee, who has been assigned the Approver role.

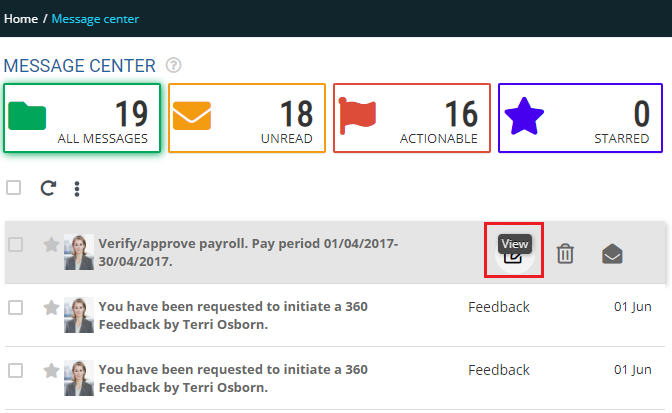

2. Click View icon on the payroll message that suggests you to verify/ approve payroll for the current pay period, as shown in Figure 1.

Figure 1

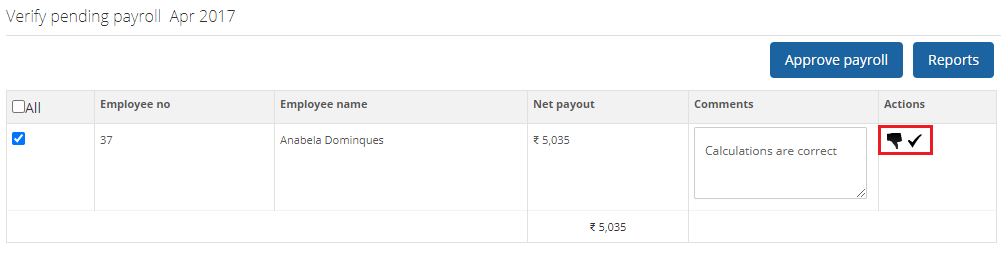

The Verify Pending Payroll page appears as shown in Figure 2. The page allows you to view various reports to verify the payroll and check if the salaries of the employees are calculated correctly.

Figure 2

3. Select the employees whose salary calculations you want to check and then click on the desired report under the Reports section to view its details for salary calculations.

4. Provide your comments for about the salary calculations in the Comments textbox.

5. Click icon to finalize the payroll or click icon

to send the payroll back to HR Manager to perform payroll calculation again for a specific employee.

Tip: If you reject a payroll and send it back to HR Manager for correction then you must provide your comments before rejecting a payroll.

You can select all the employees together and approve the payroll for all of them by selecting the All check box in the header and then clicking Approve Payroll button.

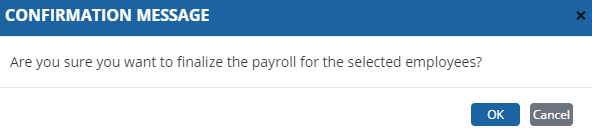

A confirmation message for the approval of payroll appears as shown in Figure 3.

6. Click OK.

Figure 3

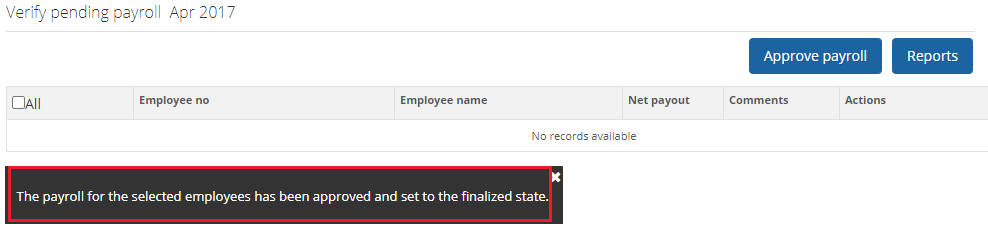

The payroll is successfully approved and all the selected records (approved/ disapproved) disappears from the page as shown in Figure 4.

Figure 4

The payroll is now sent to HR Manager for Finalization or Recalculation.

Click on the following to know more about them

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll