Do you have questions on how, when and where 24Q form filing is done? Here is a quick guide on TDS return filing.

CBDT had extended the due date of 24Q form filing for FY 2018-19 from 31st of May, 2019 to 30th of June, 2019.

What is Form 24Q?

At the time of paying salary to an employee, an employer deducts TDS (tax deducted at source) under section 192. The salary TDS return is filed in Form 24Q by the employer and is submitted on a quarterly basis. 24Q comprises of 2 annexures.

| Form 24Q (Statement for tax deducted at source from salaries) | |||

| Annexure I (Deductee wise break up of TDS) | Submitted in | Details of challan | Details of deductee |

| 1st Quarter (April – June)2nd Quarter (July – September)3rd Quarter (October – December)4th Quarter (January – March) | BSR code of branch Date of deposition of challan Challan serial number Total Amount in Challan TDS amount to be allocated among deductees Interest amount to be allocated among deductees | Employee reference number (if available) PAN of the employee Name of the employee TDS Section Code Date of payment/ credit Amount paid or credited TDS amount Education Cess | |

| Annexure II | Submitted in | Salary Details (SD) to be incorporated in Q4 for the entire year | |

| 4th Quarter (January – March) | Total breakup of the salary Deductions claimed by the employee Income from other sources House property Overall tax liability Details of salary from previous employer (if an employee joins in the mid-year) |

TDS is deducted as per income tax slab of each employee. The employer needs to consider all deductions and investments of the employee. Under any circumstance, if the employer does not deduct TDS or deducts TDS at a lower rate, they will have to provide the reasons for such non-deduction or low deduction.

How to do 24Q form filing?

Submission of Form 24Q is done either online or in person. Online filing is compulsory for:

- Government Deductor

- A company

- Person requiring Tax Audit under section 44AB in previous year

- Deductor where the number of deductees is more than 20 in a statement of a particular quarter

Due Dates of 24Q

| Quarter | Period | Due Date |

| 1st | 1st April to 30th June | 31st July |

| 2nd | 1st July to 30th September | 31st October |

| 3rd | 1st October to 31st December | 31st January |

| 4th | 1st January to 31st March | 31st May |

What if 24Q form filing is delayed?

Interest Rate

- When TDS is not deducted, 1% per month interest rate is applied from due date of deduction to actual date of deduction.

- When TDS is not deposited, 1.5% per month interest rate is applied from actual date of deduction to actual date of payment.

Late Filing Penalty

| Section | Minimum Penalty | Maximum Penalty |

| Late filing of 24Q (Penalty under Section 234E) | @200 per day until filing of return | Maximum penalty can be equal to the amount of TDS deducted |

| Non- filing of 24Q (Penalty under Section 271H) | 10,000 | 1,00,000 |

No penalty will be charged under 271H if

- TDS is deposited to the government

- Late filing fees and interest (if any) is also deposited

- Return is filed before expiry of 1 year from due date

What are the changes in 24Q Annexure II?

The CBDT has recently announced changes in the Form 16 & Form 24Q which are effective from May 12, 2019.

- Employee earning shown under Section 10The earlier format allowed employers to show consolidated salary figures which left a scope of ambiguity. According to the new format, the tax department requires break up of salary and all exemptions are mentioned under Section 10.Note: Employees are exempted for following heads under Section 10 – House Rent Allowances, Children Education Allowance, Hostel Allowance, Gratuity, Leave Travel Allowances, Commuted value of pension, Leave encashment Salary and more. In case, if an employee is claiming HRA benefits more than 1 lakh, then details of the landlord (Name & their PAN number) is mandatory to show.

- Standard Deduction under section 16(ia) has been included (this is new provision applicable from FY-18-19 onwards). New section 16(ia) has been inserted where the standard deduction is allowed while computing income chargeable under the head salaries. Amount of Standard Deduction is Rs. 40,000 or amount of salary/pension, whichever is lower. Entertainment allowance (16ii) and Professional Tax (16iii) are also exempted under section 16.

- Salary breakup from previous employer. Break up of income from previous employer to be shown separately (earlier this was one consolidated value).

- Rebate under Section 87A. Full tax rebate for individual taxpayers with annual income up to Rs.5 lakh. The income limit eligible to avail tax rebate under section 87A has been raised to Rs.5 lakh from Rs 3.5 lakh. This means the new Budget increased the limit of tax rebate under section 87A increased from Rs.2500 to Rs. 12,500.

- Detailed breakup of deductions under Chapter VI (earlier it was only in two broad categories – all sections with a consolidated cap of Rs. 1,50,000 and rest of the sections all together). For FY 2019-20, there will be separate line items for each Section – e.g. ’80CCE’, ’80CCF’, ’80CCG’, ’80C’, ’80CCC’, ’80CCD(1)’, ’80CCD(1B)’, ’80CCD(2)’, ’80D’, ’80E’, ’80G’, ’80TTA’ and ‘OTHERS’ will have one line item (if applicable).

- Items wise details – Section Chapter IV

- 80C – Amount of deduction in respect of life insurance premium, contributions to provident fund etc.

- 80CCC – Amount of deduction in respect of contribution to certain pension funds.

- 80CCD(1) – Amount of deduction in respect of contribution by taxpayer to notified pension scheme.

- Note – Aggregate amount of deduction under section 80C,80CCC and 80CCD (1) should be <=150,000.00).

- 80CCD(1B) – Amount of deduction in respect of amount paid/deposited under notified pension scheme in addition to Rs 150,000/-.

- 80CCD(2) – Amount of deduction in respect of contribution by employer to notified pension scheme.

- 80D – Amount of deduction in respect of health insurance premium.

- 80E – Amount of deduction in respect of interest on loan taken for higher education.

- >80G – Amount of total deduction in respect of donations to certain funds, charitable institutions, etc.

- 80TTA – Amount of deduction in respect of interest on deposits in savings account.

Things to remember when working on 24Q Form

It is important to verify the challans, all PAN numbers, and try to match challan with through OLTAS or NSDL. Remember to file Signed Form-27A with the TDS return.

Role of an HR Software in 24Q Form Filing

Taking care of statutory legislation and considering all rules while filing TDS return is a tedious yet an essential task. An automated payroll software accelerates the process and reduces data entry errors. Many organizations use online payroll software to manage end to end payroll activities along with meeting statutory compliance. We take pride in introducing you to Empxtrack Payroll Software, an easy-to-use SaaS based solution that integrates all aspects of payroll processing and stays compliant with latest payroll legislations of the country. Empxtrack assist employers in filing 24Q form and TDS return and in just 4 steps payroll administrator can carry out e-filing of 24Q returns.

Step 1: Calculate Monthly payroll

Step 2: Capture Monthly TDS Challans

Step 3: Generate 24Q Quarterly Text files

Step 4: Generate FVU files (Directly upload-able at Traces portal)

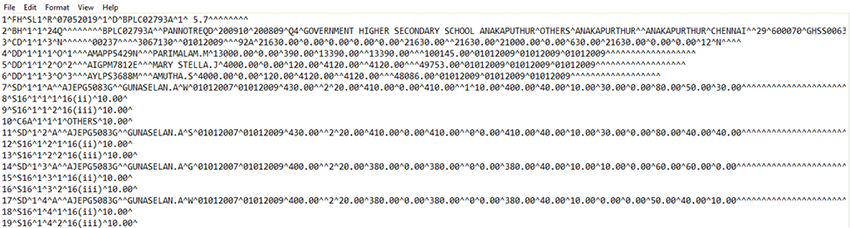

Old file format

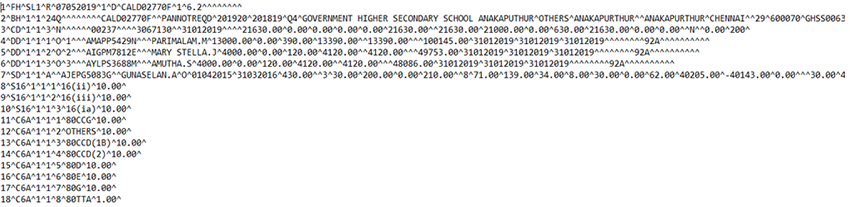

New file format

Get in touch with our experts to understand how Empxtrack payroll software can help you in TDS return & Form 24Q filing.

What to mention in remarks if salary is below taxable.

I am a Central Govt deductor. One of our employees reported to our office from previous establishment (Central Govt office) in November 2019. My query is, while filling Annexure II, should we fill only the gross salary paid by our office or should it include the gross salary paid by the previous office also? Thanks in advance

It depends, if the employer has changed then you should fill the gross salary paid by your office only and the previous office will send their own values. If the previous office did not submit their values then you can submit total values i.e. yours & previous office.

Hello,

Great And nice thought for presenting of 24Q Form Filing – A Quick Guide on filing TDS Return Online.