Understanding of the salary structure is essential for HR professionals and individuals considering a job offer. A clearly outlined salary structure not only clarifies pay distribution, but also supports organizational objectives.

This guide covers the complexities of salary structures and various terms associated with them.

Table of contents

- What is a Salary Structure or a Pay Structure?

- Who Does the Salary Structure Apply to?

- Importance of Establishing a Clear Salary Structure

- Types of Salary Structures

- Examples of Salary Structures in Different Geographies

- Variable Salary Components and their Benefits

- Best Practices for Creating an Effective Salary Structure

- Conclusion

- FAQs

What is a Salary Structure or a Pay Structure?

A salary structure also known as compensation structure or pay structure, refers to the framework that displays how employees are paid. It further provides a systematic approach to establishing pay levels for different roles and responsibilities within a company. Salary structure includes various components such as base salary, allowances, bonuses, benefits, deductions, and other perks.

Moreover, a pay structure consists of salary grades or pay grades, which group together jobs with similar pay levels in the market. It offers valuable insights into creating a competitive and fair compensation framework.

Who Does the Salary Structure Apply to?

Salary structures apply to all the employees within an organization, irrespective of their level, department, or geographic location. Hence, whether they hold entry-level positions, mid-level management roles, or executive titles, each employee’s compensation is therefore determined within the parameters defined by the structure.

This ensures that employees are paid fairly and competitively based on the value of their roles within the organization and in comparison to the external job market.

Importance of Establishing a Clear Salary Structure

Implementing a well-designed compensation structure offers several benefits to organizations as well as to employees.

Importance for Organizations

Having a well-designed salary structure offers several benefits for organizations:

| Recruitment and Retention | It helps attract and retain top talent by ensuring competitive pay levels aligning with industry standards. |

| Budgeting and Planning | Helps in managing payroll costs effectively. Improves workforce planning and budgeting by clearly outlining salary costs for different roles and departments. |

| Compliance and Risk Management | Adhering to a structured compensation framework reduces legal risks from discriminatory pay practices and labor law violations. |

| Internal Equity | It promotes internal equity by ensuring that employees performing similar roles are paid equitably. |

| External Competitiveness | Enables an employer to benchmark their compensation practices against industry standards and local market conditions. |

Importance for Employees

A transparent and well-structured salary system is also beneficial for employees:

| Clarity and Transparency | It provides clarity on where their role fits within the organizational hierarchy and the corresponding pay range. |

| Fairness and Equity | Compensation based on predefined criteria such as skills, experience, and job responsibilities, fosters fairness and thereby promotes a positive work environment and reduces turnover. |

| Predictability and Understanding | It offers a clear career ladder and advancement opportunities. This removes ambiguity in pay discussions and clarifies the market-based rationale behind their compensation. |

| Motivation and Performance | Linking pay for performance metrics motivates employees to excel and achieve organizational goals, thus contributing to overall business success. |

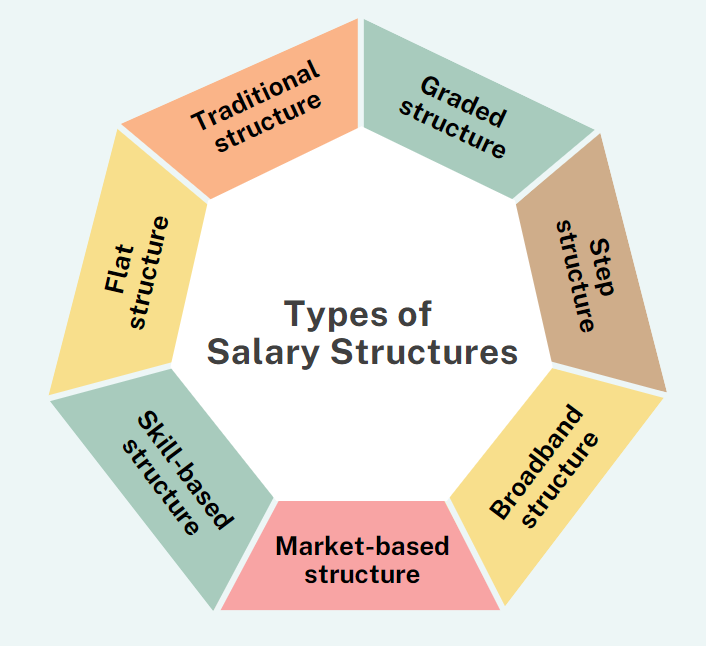

Types of Salary Structures

Global pay structures can vary significantly based on factors such as industry norms, company size, and geographical presence. Each structure may additionally have its advantages and challenges.

Here are some common types of pay structures:

Traditional and Hierarchical Structure

This is a commonly used pay structure. Employees move up in the hierarchy based on performance, experience, and seniority. Consequently, the salary increases at each level. Though this approach rewards loyalty and longevity, it may discourage high performers from working at lower levels.

Graded Structure

In this structured approach, jobs are categorized into specific grades. Employees accordingly progress through these grades annually or bi-annually as part of their performance reviews. This system strongly motivates employees by providing clear advancement opportunities based on their performance and achievements.

Step Structure

The Step Structure rewards employees based on their tenure, thus aiming to encourage loyalty with incremental pay raises. However, its focus on tenure may limit career advancement opportunities compared to structures emphasizing performance or skills. Nonetheless, it effectively enhances employee retention and stability in organizations valuing longevity and experience.

Broadband Structure

The Broadband Salary Structure reduces pay grades and widens salary ranges, allowing flexibility in setting salaries based on experience and performance. While this may lead to larger salary disparities among employees in similar roles and quick salary cap reach, but it remains popular for its adaptability to market conditions and organizational needs.

Market-based Structure

This approach sets salaries based on industry standards, job demand and regional factors. Thus this strategy may attract top talent and improve retention rates. However, it may increase labor costs and potentially discourage internal career growth and promotions due to competitive external benchmarks.

Skill-based Structure

A skill-based structure pays employees based on their skills and qualifications. It values each employee’s abilities and encourages them to develop professionally. However, it might create competition instead of teamwork and could lead to differences in wages among employees based on their skills.

Flat Structure

This gives every employee the same base pay, no matter their role, experience, or tenure. Performance bonuses or profit-sharing may be added, but everyone starts with an equal base salary. Moreover, this fairness aims to foster teamwork, but it might not motivate top performers who could feel their efforts aren’t rewarded differently.

Examples of Salary Structures in Different Geographies

Pay structure may vary in different countries, depending on several factors. These include local labor laws, economic conditions, cultural norms, and overall cost of living.

- In countries with strong labor regulations, such as many in Europe, pay structures often emphasize minimum wages, extensive benefits packages, and robust worker protections.

- On the other hand, in emerging economies like those in parts of Asia and Africa, pay structures may be more flexible, reflecting lower overall wage levels but often with comparatively less comprehensive benefits.

- Cultural norms also play a significant role. For instance, countries in Scandinavia prioritize egalitarianism, resulting in relatively narrow pay differentials between top executives and entry-level employees.

- Economic conditions, such as inflation rates and currency strength, further influence pay structures by affecting the purchasing power of wages and the affordability of benefits.

Salary Structure in USA

The pay structure in USA consists of the following components:

- Base Salary: The fixed amount paid to an employee on a regular basis, typically annually or bi-weekly.

- Bonuses and Incentives: Additional compensation based on individual or company performance. This includes performance bonuses, profit-sharing, or stock options.

- Commission: For sales or revenue-generating roles, a percentage of sales or revenue is achieved. For example: 5-15% of sales, paid monthly or quarterly.

- Overtime Pay: Additional compensation for hours worked beyond the standard workweek (typically over 40 hours per week).

- Benefits Package: Includes various non-monetary benefits provided by the employer.

- ✔ Health Insurance: Employer-sponsored medical, dental, and vision coverage.

- ✔ Retirement Plans: 401(k) or similar plans with employer matching contributions.

- ✔ Paid Time Off: Vacation days, sick leave, and holidays.

- ✔ Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): Pre-tax accounts for medical expenses.

- ✔ Life and Disability Insurance: Coverage for unexpected events.

- ✔ Education Assistance: Tuition reimbursement or assistance programs.

- Stock Options or Equity Grants: Based on company policy and seniority, this is offered by some companies to provide employees with ownership in the company.

- Relocation Allowance: Assistance provided to employees relocating for work. For example: Lump-sum payment or reimbursement for moving expenses.

- Perks and Allowances: Additional allowances or perks provided to employees. For example: Company car, mobile phone stipend, meal allowances.

Note:

- » Taxation: Various components such as base salary, bonuses, and commissions are subject to federal and state income taxes.

- » Variable Components: Bonuses, commissions, and stock options can vary based on individual or company performance.

- » Customization: Employers may customize the structure based on industry norms, company size, and geographic location.

Salary Structure in India

Understanding the ideal pay structure in India involves key components such as Basic Salary, allowances, and statutory deductions like Provident Fund and Gratuity.

Ideal pay structure with basic components

| Components | Recommendation |

|---|---|

| Basic Salary | 40-50% of CTC |

| Dearness Allowance (DA) | 5% of CTC |

| House Rent Allowance (HRA) | 50% of Basic + DA if metro and 40% if non-metro |

| Conveyance Allowance | Rs. 1600 per month |

| Medical Allowance | Rs. 1250 per month |

| Leave Travel Allowance (LTA) | 10% of basic (no benchmark) |

| ESIC (Employer contribution) | 3.75% of Gross salary |

| ESIC (Employee contribution) | 0.75% of Gross salary |

| Special Allowance | Balancing component |

| PF (Employer contribution) | 12% of Basic + DA |

| PF (Employee contribution) | 12% of Basic + DA |

| Professional Tax | State-wise |

| Labor Welfare Fund | State-wise |

Basic Salary

This is the core component of the salary and is taxable. It is usually the largest component of the CTC making up for 50% of the total CTC.

Gross Salary

It is the total pay that an employee receives before taxes and other deductions. Gross salary includes income from all sources and is not confined to only the income received in cash.

Net Salary

It is the amount you receive after deductions have been taken out.

Allowances

- » Dearness Allowance (DA): DA is provided to mitigate the impact of inflation. It is usually 5-10% of basic salary.

- » House Rent Allowance (HRA): Provided to employees to meet rental expenses. This constitutes 40-50% of Basic Salary, depending on the city of residence.

- » Leave travel allowance (LTA): Remunerates employees for their travel within the country. This component is widely used by employers due to the tax benefits associated with it.

- » Conveyance Allowance: The expenses related to office commute. This is reimbursed in the majority of companies.

- » Medical Allowance: This covers medical expenses not covered by insurance. This is optional to be paid by companies.

- » Health Insurance: This is provided by employers for medical, dental, and vision coverage.

- » Child Education Allowance: This allowance is provided for the tuition fees of employees’ children and is tax-deductible up to Rs. 100 per month for up to two children.

- » Special Allowances: Miscellaneous allowances which may vary based on the company’s policy. This may include newspaper bill, mobile bill, internet expense, vehicle running expense or others.

- » Performance Bonus: Variable component based on individual or company performance. This may be paid annually or semi-annually to employees.

Statutory Deductions and Contributions

These benefits include contributions to Provident Fund (PF), ESIC, and Gratuity.

- » EPF: 12% of Basic Salary from both employee and employer. Mandatory for companies with 20 employees.

- » ESIC: Deductions are mandatory for employees whose gross salary is not more than Rs. 21,000. Contribution rate is 0.75% of the employee’s wages, while the employer contributes 3.25% of the employee’s wages.

- » TDS: As per income tax guidelines, tax is calculated on the employee’s salary, before. employees receive their net salary.

- » Professional Tax (PT): A state-level tax imposed on income earned by individuals working in government or private sectors. Tax rates vary across states based on income slabs.

- » Gratuity: Statutory benefit paid by employers as a lump sum upon an employee”s retirement, resignation, or death. This is 4.81% of Basic Salary, payable upon 5 years of service.

- » LWF: Employers contribute small percentage of the employee’s wages to the LWF. It covers benefits such as healthcare, education, housing, and social security. LWF ensures well-being and better working conditions.

Incentives and Commission

This is applicable for sales or target-based roles. Incentives are most commonly paid monthly, quarterly or annually, as per company policy.

Stock Options

Offered by some companies, providing ownership in the company. This may vary based on company policy and seniority of the employee.

Note:

- » Tax Deductions: Components like Basic Salary, DA, HRA (under certain conditions), and Gratuity are taxable.

- » Variable Components: Performance Bonus, Incentives, and Commission may vary based on individual or company performance.

- » Customization: Companies may customize the structure based on industry norms, seniority, and location-specific factors.

Salary Structure in Middle East

In the Middle East, there are 2 categories of employees: local employees and expatriates. Each may have different salary structures based on individual requirements and market norms.

Here is an example of salary breakup for employees in the UAE:

- Basic Salary: The core component of the salary paid on a monthly basis. Example Range: AED 5,000 – AED 20,000 per month depending on the role and seniority.

- Housing Allowance: Covers rental expenses or housing stipend. Example: AED 2,000 – AED 10,000 per month, depending on the employee’s position and location (often higher in cities like Dubai or Abu Dhabi).

- Transportation Allowance: Can be a fixed allowance or reimbursement for commuting expenses. For example: AED 500 – AED 2,000 per month.

- Utilities Allowance: Contribution towards utility bills such as water, electricity, etc. AED 300 – AED 1,000 per month.

- Education Allowance: Provided for children’s education expenses, including school fees. For example, AED 1,000 – AED 5,000 per child per month.

- Healthcare Insurance: A comprehensive coverage for medical expenses. Mostly fully covered by employer or with a co-payment structure depending on the plan.

- Annual Leave and Airfare: Expatriates receive paid annual leave and annual airfare or cash equivalent for home leave. For example, 30 days of paid annual leave with an annual airfare ticket to their home country.

- End of Service Benefit (Gratuity): Typically one month’s salary for each year of service.

- Performance Bonus: Variable component based on individual or company performance. Example: 10-20% of annual basic salary, paid annually or semi-annually.

- Relocation Allowance: Assistance provided to employees relocating for work. Example: Lump-sum payment or reimbursement.

Note:

- » Taxation: Many countries in the Middle East do not impose income taxes on employee salaries. However, there may be other types of taxes or fees applicable.

Variable Salary Components and their Benefits

Many companies offer flexibility to employees to structure their compensation based on their preferences. Explore variable salary components in detail.

What are Variable Salary Components?

Variable salary components, often referred to as a “bucket-based approach,” allow a breakup of salary structure based on employee needs. This approach acknowledges that not all employees have identical needs or financial circumstances.

For instance, employees who own their homes may not require a house rent allowance. Instead, these funds can be reallocated to other allowances that offer greater tax benefits. Conversely, employees who rent accommodations may require a higher housing allowance. Meanwhile, those who own homes might prefer to allocate these funds towards healthcare or retirement savings.

Benefits of Variable Salary Components

Flexibility in Compensation Management

These components allow organizations to adjust monetary allocations between different components such as basic salary, housing allowance, travel allowance, medical benefits, and more. This flexibility ensures that employees receive a package that aligns closely with their preferences.

Maximizing Tax Benefits

Employers can help employees to minimize their tax liabilities, while maximizing take-home pay. This can be done by redistributing allowances away from taxable components (like HRA) towards non-taxable benefits (such as medical reimbursements or food coupons).

Employee Empowerment and Satisfaction

Adding variable salary components empowers employees by allowing them to have a say in how their compensation is structured. This personalized approach enhances employee satisfaction. They feel valued when an employer accommodates their individual needs, through customized salary structure.

Ultimately, it’s about creating win-win situations where employees feel financially secure and valued, and employers benefit from increased engagement and productivity.

Best Practices for Creating an Effective Salary Structure

Here are some best practices to consider:

Conduct a Thorough Job Analysis

Conducting a thorough job analysis is essential for creating an effective salary structure. This involves carefully evaluating the required skills, knowledge, experience, and responsibilities for each position. By gathering detailed information about job duties, qualifications, and the work environment, you can also accurately determine the relative value and importance of each role within your organization.

Conduct Market Research

Begin by conducting thorough market research to understand prevailing salary trends and industry standards for similar roles. This research would further provide insights into what candidates expect and enable organizations to position themselves competitively in the job market.

Establish Competitive Salary Ranges

Develop clear salary ranges for each job level or function based on market data, internal equity considerations, and organizational budget. This provides flexibility in negotiating salaries while maintaining fairness across different roles.

Consider Compensation Philosophy

Align the salary structure with the organization’s compensation philosophy, values, and strategic objectives. This ensures that compensation decisions support overall business goals and employee engagement.

Develop Pay for Performance Programs

Implementing a pay-for-performance program motivates employees and aligns their efforts with organizational goals. Link financial incentives, such as bonuses or merit increases, to specific performance metrics like sales targets, customer satisfaction, project timelines, or cost savings. For instance, top performers receive higher base salaries, cost-of-living adjustments, and substantial bonuses, while average performers get a standard salary with a modest bonus.

Regularly Review and Update Equally

Regularly reviewing and updating salary structures to ensure competitiveness and alignment with organizational and market needs. Typically, employers should assess the salary structure every three to five years or more frequently during significant changes such as mergers, acquisitions, or shifts in the labor market. Then, during reviews, evaluate if the structure supports the organization’s total rewards and HR strategy and accurately reflects current market conditions. Adjust pay grades, salary ranges, and job descriptions as needed to attract and retain top talent.

Communicate Effectively

Communicate the salary structure clearly to employees, managers, and stakeholders. Transparent communication fosters trust and understanding regarding how salaries are determined and promotes fairness in pay practices.

Train HR and Managers

Provide training to HR professionals and managers on how to effectively use the salary structure in recruitment, performance management, and compensation discussions. This ensures consistency and compliance with organizational policies.

Ensure Compliance with Laws

Setup an effective salary structure that is in compliance with laws and regulations of the state. Besides this, stay informed about minimum wage, overtime rules, employee classification, and equal pay laws at federal and state levels. Conduct regular audits to address compliance issues such as misclassification or pay disparities based on protected characteristics. Implement clear employee compensation policies outlining salary determination, bonuses, and benefits criteria. Finally, transparently communicate these policies to build trust and confidence in fair pay practices, promoting equal pay and fostering a diverse workforce based on job-related factors.

Conclusion

Understanding salary structures empowers organizations to manage compensation effectively. A well-designed framework ensures fair pay that aligns with strategic goals. Effective salary structures are not only essential for attracting and retaining talent but also for ensuring organizational transparency and fairness.

Implementing a cloud-based payroll software makes it easy to setup salary structures and manage payroll processes efficiently. Empxtrack simplifies setting up multiple salary structures for different grades of employees. It offers flexibility to set up payroll variables and salary heads as per your needs.

For organizations looking for ways to easily manage salary structures and enhance their HR processes, feel free to reach out to us here. Explore our solutions to refine your compensation strategies and ensure fair, competitive pay across your organization.

Frequently Asked Questions

Q1. | How many salary structures does a company usually have? |

| Ans. | A company may have multiple salary structures for different grades of employees. The number of salary structures may also vary depending on the company size, industry, geographical location, and organizational structure. |

Q2. | What is a CTC salary structure, and how does it help in budget planning? |

| Ans. | A CTC (cost to company) is the total cost incurred by a company in employing an individual, including all benefits and perks. It helps in budget planning thus allowing organizations to allocate resources effectively, forecast expenses accurately, and manage financial commitments smoothly (such as payroll, taxes, etc.) within predefined budgets. |

Q3. | Can different types of employees have varying pay structures? |

| Ans. | Yes, different types of employees can have varying pay structures based on their roles, responsibilities, skills, experience and market value. |

Q4. | What is meant by geographical pay differential? |

| Ans. | Geographical pay differential refers to variations in salary or compensation levels based on the location or geographic region where an employee works. It further takes into account factors such as cost of living, market conditions, and economic disparities between geographic regions. This approach therefore ensures that salaries are competitive and helps to retain talent. |

Q5. | Can salary structures be beneficial if my organization operates across multiple geographical locations? |

| Ans. | Yes, salary structures can be highly beneficial for organizations operating across multiple geographical locations. It provides consistency and fairness in compensation practices. This moreover ensures competitiveness in diverse markets, helps in budgeting and financial forecasting effectively, and supports compliance with local labor laws and regulations. Additionally, structured pay scales can help in attracting and retaining talent by offering transparent and equitable compensation packages across different regions. |

Q6. | Who is responsible for maintaining salary structures? |

| Ans. | Maintaining salary structures is the responsibility of the Human Resource and Finance (payroll) department. |

Q7. | How often should salary structures be reviewed and updated? |

| Ans. | Employers should examine the overall salary structure at least every three to five years. Besides this, it should be determined whether the structure is still aligned with the company’s needs and the labor market. |

Q8. | What constitutes the default compensation structure? |

| Ans. | The default pay structure varies as per the country an employee is working in. The salary components included in the pay structure for different geographies have been explained above. Refer to this section |

Q9. | What do salary heads refer to? |

| Ans. | Salary heads are the salary components used to create a pay structure. For example, Base salary, HRA, DA, Special allowance, Benefits, Commissions, etc. |

Q10. | What should a startup consider while creating a salary structure? |

| Ans. | A few things to consider to setup salary structure in a startup are: » Research industry standards and competitor compensation packages » Consider budget constraints before offering salary » Define job roles and responsibilities to determine appropriate salary levels based on skills, experience, and market demand » Be flexible to adjust salary structures as the startup grows » Ensure fairness and equity across the organization » Offer competitive benefits and perks (e.g., health insurance, equity options) » Adhere to labor laws and regulations regarding minimum wages, overtime pay, and other statutory requirements » Communicate the salary structure and compensation components clearly to employees » Link salary increases and bonuses to performance metrics to incentivize high performance » Plan long-term sustainability of the salary structure amidst potential fluctuations in revenue and funding Using an online payroll software, such as Empxtrack, can also help in managing multiple salary structures for different grades of employees effectively. |

Q11. | Can salary structures help in managing pay disparity? |

| Ans. | Yes, salary structures can help manage pay disparity by promoting transparency, equity, market alignment, and performance-based pay practices within organizations. |

Q12. | What is the salary structure format? |

| Ans. | The salary structure format refers to the organization and presentation of various components that make up an employee’s total compensation package. It typically includes details such as base salary, allowances, bonuses, benefits, and deductions, structured in a clear and standardized format. This further ensures transparency and consistency in pay practices within an organization. |

Q13. | What is basic pay in salary structure? |

| Ans. | Basic pay in a salary structure refers to the fixed amount of compensation that an employee receives regularly as wages or salary, excluding any additional allowances, bonuses, or benefits. It thus forms the foundational component of an employee’s total earnings and is often used as the basis for calculating other benefits and deductions. |