Employee data verification and update is a necessary step in payroll preparation. HR needs to check out basic details of employees like salary structure, date of joining, attendance, state, PAN information, Bank account number, UAN information. These details are important for processing payroll of a specific month. Empxtrack allows you to verify and update employee data and attendance while running the payroll.

For employee data verification and update, follow the steps:

- Login as an HR Manager/ HR Admin.

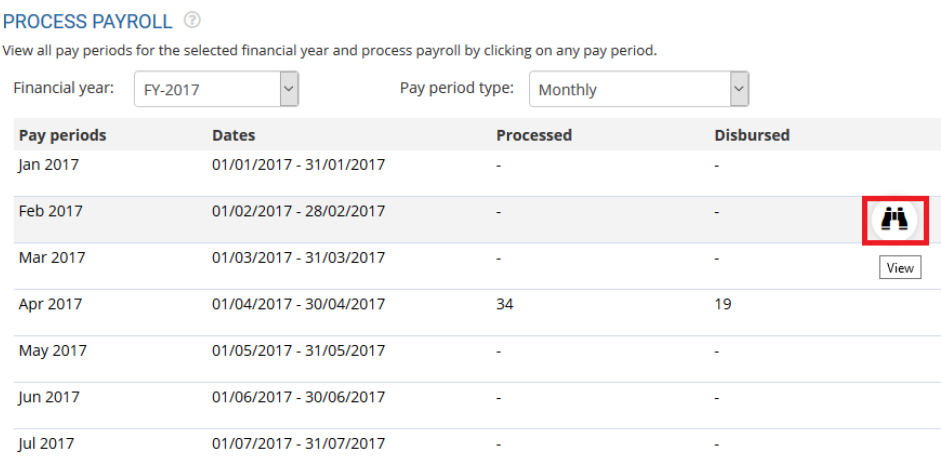

- On the Homepage, click on the Payroll tab. The Process payroll page appears on the screen.

Note: The application displays tabs depending on the Empxtrack product version that you are using. - The page displays the selected financial year in Financial Year dropdown, and the selected pay period type in Pay Period Type field. All the pay periods of the selected financial year appears in the list. It displays number of processed and disbursed payrolls in Processed and Disbursed columns.

Figure 1

Hover the mouse in a tabular line of any pay period, View icon appears that allows you to view details of the respective pay period.

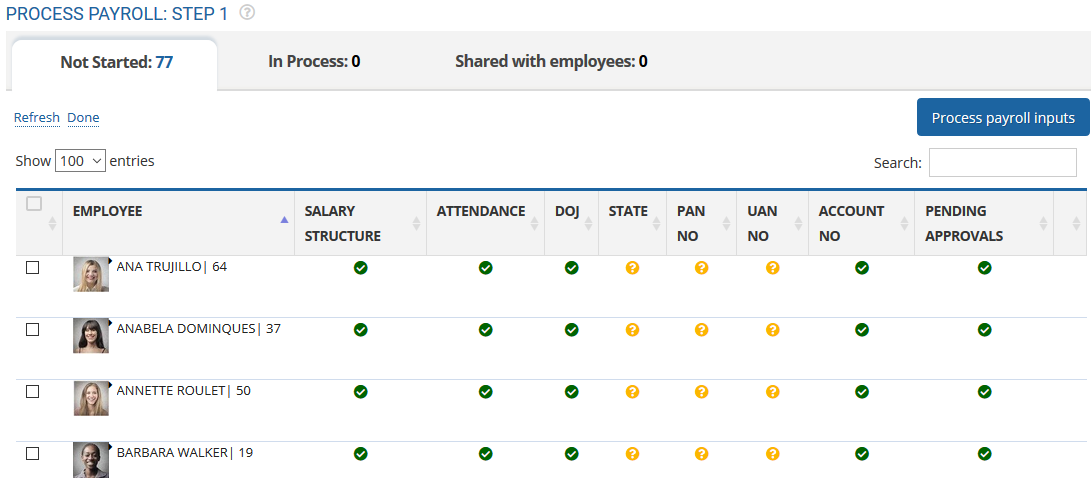

- Click View icon to initiate payroll processing. The Process payroll: Step 1 page appears with a list of employees and their eligibility for a payroll run. The page displays employee information along with the status of each field.

In the Not started tab, the payroll processing hasn’t started and some parameters may require information to start payroll preparation. During payroll preparation, check out the values of various parameters such as Date of Joining, Attendance, Salary structure, State (for professional tax), PAN No (for TDS, Form 24Q), UAN (for PF), Bank Account (salary transfers) and Pending approvals (correct calculations).There are 3 symbols that show the status of information for a specific pay period:- Green tick

: It displays that data is available for that field.

: It displays that data is available for that field. - Red cross

: It shows data is not available for a column, and the column is mandatory. Payroll cannot be processed without providing information for that specific field.

: It shows data is not available for a column, and the column is mandatory. Payroll cannot be processed without providing information for that specific field. - Yellow question mark

: Data is not complete and may lead to incorrect calculations or wrong reports.

: Data is not complete and may lead to incorrect calculations or wrong reports.

Figure 2

- Green tick

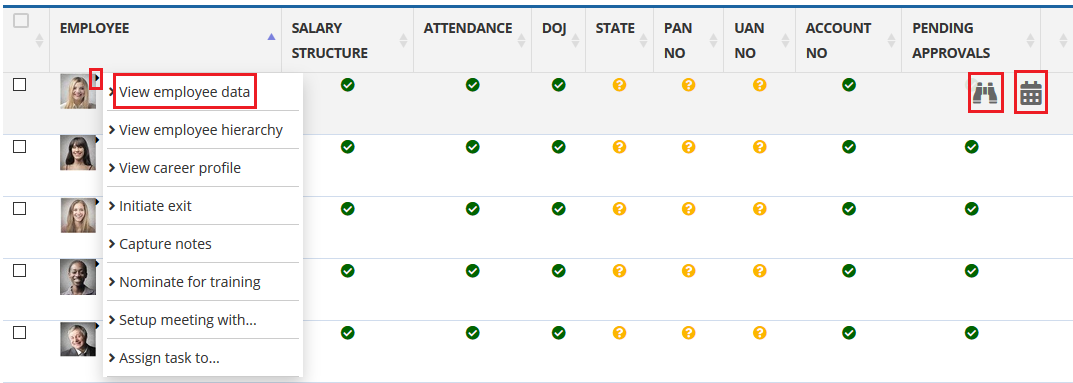

- You can update the missing information or edit the existing employee information right there.

a. To edit/update the employee information, hover the mouse on the arrow shown on employee image. A menu will multiple options appears. Click on the View employee data to modify employee information. If employee data (like State, Date of joining, PAN, UAN) is missing, follow steps displayed on the update employee basic details and confidential IDs help pages.

Figure 3

b. Salary structure and date of joining are the mandatory fields for processing payroll. If this information is incomplete for employees, you won’t be able to process payroll for those employees. Learn how to assign a salary structure to employees.c. If attendance data is incomplete for a specific employee, hover the mouse in that row and click on the Manage subordinate attendance icon to regularize attendance records. You can either regularize attendance for some days for an employee or upload attendance data for multiple employees in one go.

- Refresh the page post data changes by clicking on the Refresh link shown.

- Once data is updated, select employees and click Process payroll inputs button to process the payroll information.

Click on the following to know more about them

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll