Capture challan TNS 281 details to deposit Tax Deducted at Source/ Tax collected at source (TDS/TCS) every month. After submitting Challan TNS281 to income tax department, the details of the challan are saved in the Empxtrack system. These details can be used later to fill Form 24Q.

A tax payer gets a tear-off portion from the challan from the bank with a unique Challan Identification Number (CIN) after getting it stamped by the bank.

CIN is a unique number containing the following information:

- 7 digit BSR Code of the bank branch where tax is deposited.

- Date of presentation of the challan (DD/MM/YY)

- Serial number of challan in that branch on that day (5 digits)

The CIN has to be quoted in the Income Tax Return as a proof of payment. It is also required for any further inquiry.

To capture the details of Challan TNS281, you need to:

1. Log into the system as HR Manager/ HR Admin.

2. On the Homepage, click on the Payroll tab. By default, the Process payroll page appears.

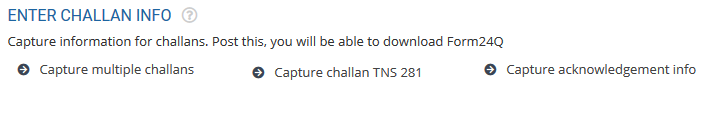

3. Under Payroll Shortcuts, click on the Enter Challan Info tab. The Enter Challan Info page appears as shown in Figure 1.

4. Click Capture Challan TNS 281 link.

Figure 1

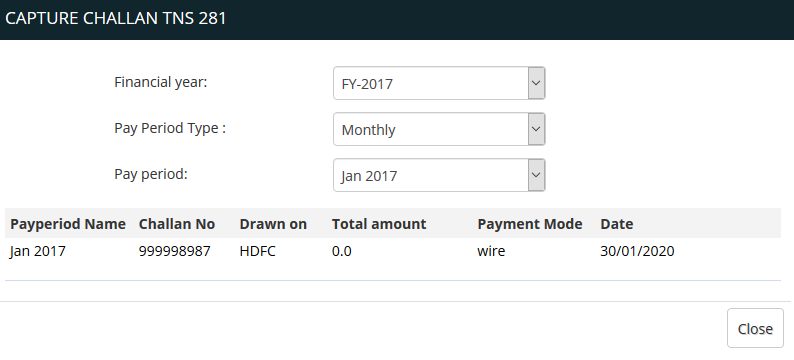

The Challan TNS 281 page appears, as shown in Figure 2.

The page displays one or more challan records for each pay period of the current financial year, for which the challan was captured. Although, you submit only one Challan TNS281 for a pay period, all the challans captured for a pay period can be seen on the page.

Figure 2

5. Select the financial period from the Financial Period dropdown, for which you wish to see the challans.

6. Select the pay period type and pay period from the Pay Period Type and Pay Period dropdown to see challans of the specific pay period.

By default all the challans of the current financial year are displayed.

Click on the following links to know more about them:

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll