Capture multiple challans used by Indian companies to deposit Advance tax, Self Assessment tax, Tax on Regular Assessment, Surtax, Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders. Empxtrack enables the users to capture multiple challans for the selected employees each time when the salary is calculated.

To capture challans, you need to:

1. Log into the system as HR Manager/ HR Admin.

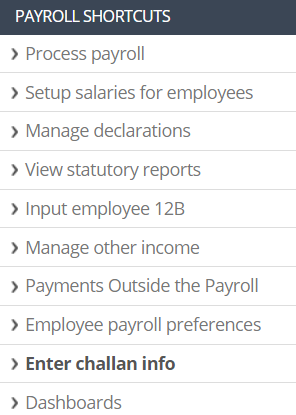

2. On the Homepage, click on the Payroll tab. By default, the Process payroll page appears. Under Payroll Shortcuts, click on the Enter Challan Info tab.

Figure 1

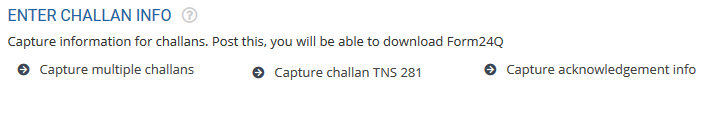

3. A page appears that allows entering challan information for Form 24Q. Click on the Capture multiple challans link.

Figure 2

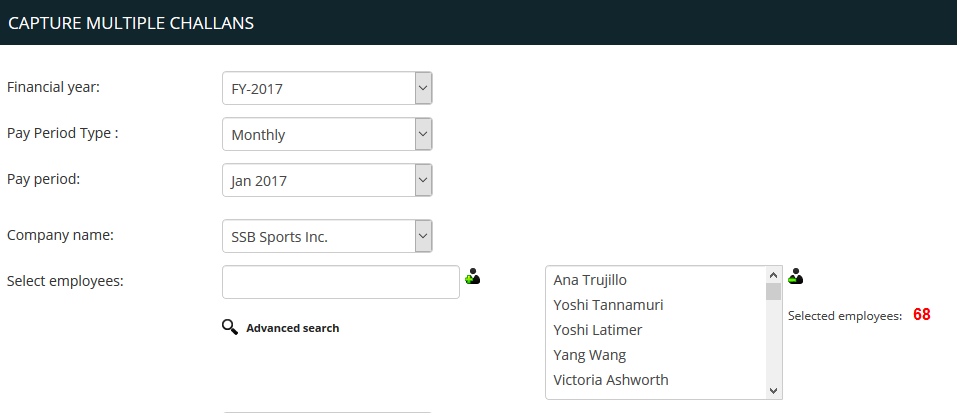

4. A new tab opens as Execute Template. Fill in the information to proceed further. Select the relevant info for Financial year, Pay period type and Pay period dropdowns.

5. Select Company name and name of employees appear in the next field. You can remove some or keep all employees for whom you want to capture challans. If you remember the names of employees, you can type their names in Enter Name field and click (+) sign to select them.

Alternatively, you can click on the Advanced search icon to select employees. To know more about performing advanced search, click Advanced Search.

Figure 3

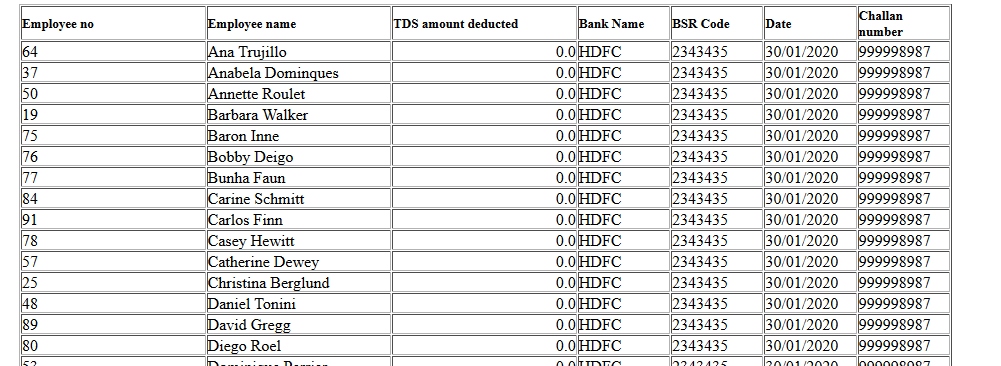

6. Click Verify Challan.

A new browser window displaying the TDS amount deducted from the salaries of the selected employees for the selected pay period appears, as shown in Figure 4.

7. Close the window after verifying the TDS deduction of selected employees.

Figure 4

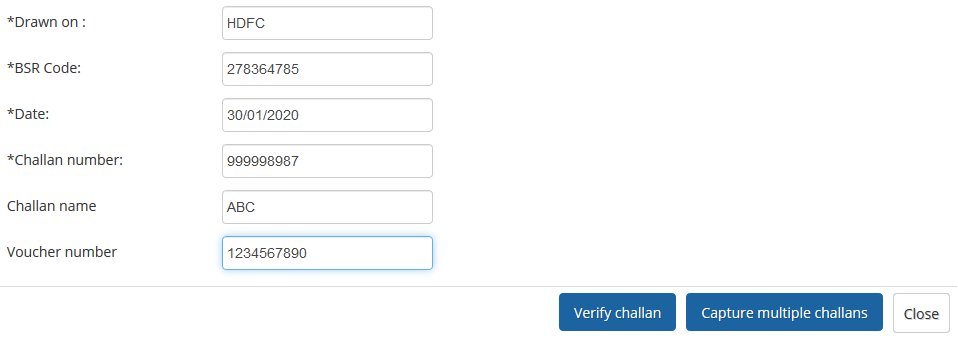

8. Provide the bank and the branch name where you are submitting the challan in the Drawn On field.

9. Provide the BSR code of the bank branch in the BSR Code field.

The Online Tax Accounting System (OLTAS) allows collection, accounting, and reporting of the receipts and payments of Direct Taxes on-line through a network of bank branches.

BSR Code is a 7 digit code of the bank branch where tax is deposited.

10. Provide the date on which challan was deposited in the Date field.

11. Provide the Challan Number, Challan Name and the Voucher Number in their respective fields.

12. Click Capture Multiple Challan, as shown in Figure 5.

Figure 5

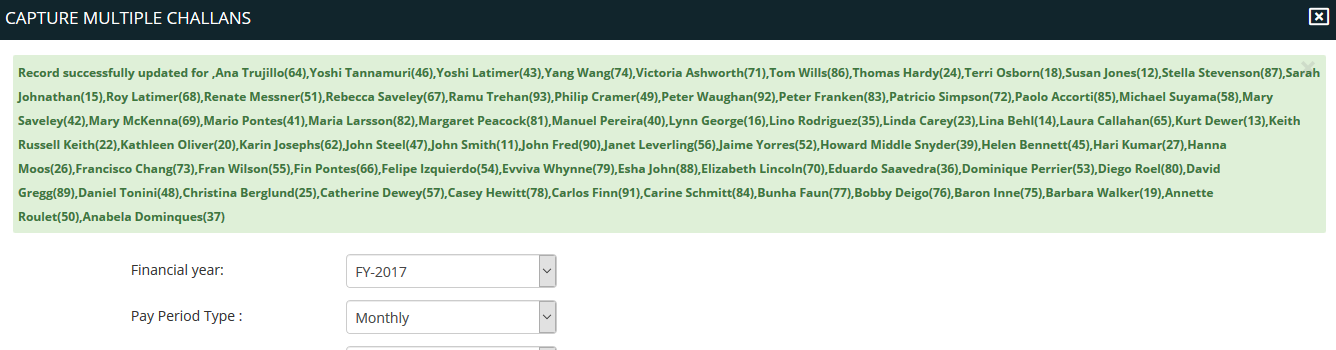

The details of the challan are saved and a message about the challan records update appears on top of the page, as shown in Figure 6.

Figure 6

Learn more about Empxtrack Payroll

Click on the following to know more about them:

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll