Empxtrack allows you to run and download various kinds of report at different stages of running payroll. These reports include pre-payroll run, post payroll calculation report, bank report, statutory deduction, consolidated payroll and variation reports.

Pre-payroll Run Report

This report gives all the details of the employee prior to running the payroll and calculation of Monthly heads. It displays any critical changes in the employee data (such as salary changes, address changes, dependent changes etc.) which may impact payroll outcomes. The report also displays the lack of critical elements of employee data.

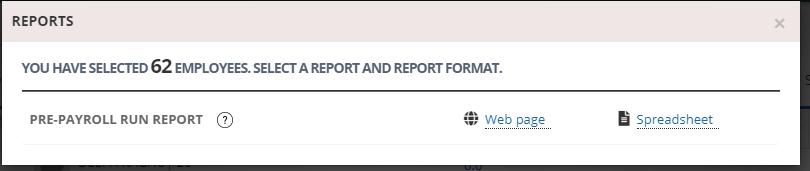

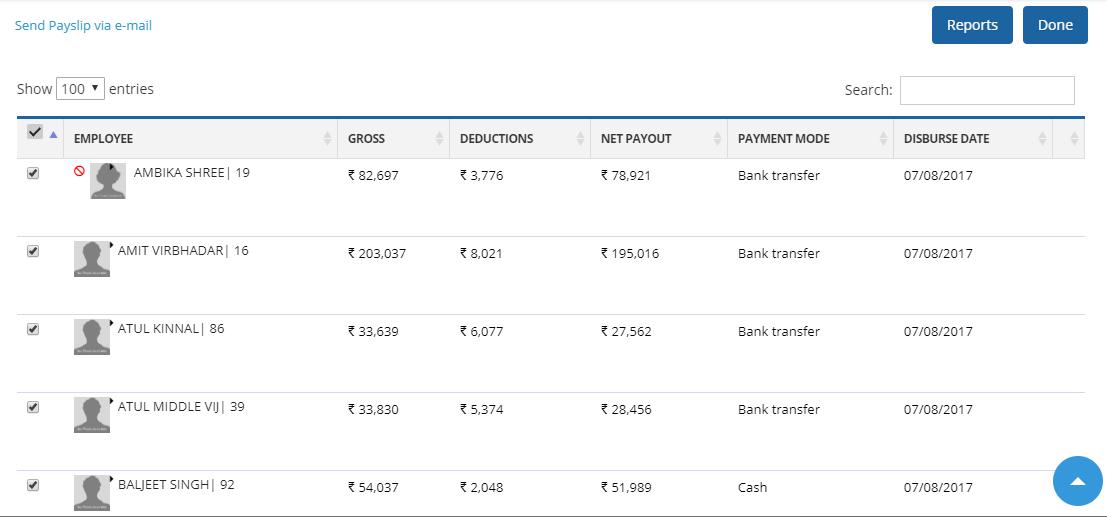

- To run pre-payroll run report, select employees whose payroll is initiated and click on the reports button as shown in Figure 1.

Figure 1

2. A dialog box appears with the suggested pre-payroll run report. Choose the option to view report in a browser (as a web page) or download in spreadsheet.

Figure 2

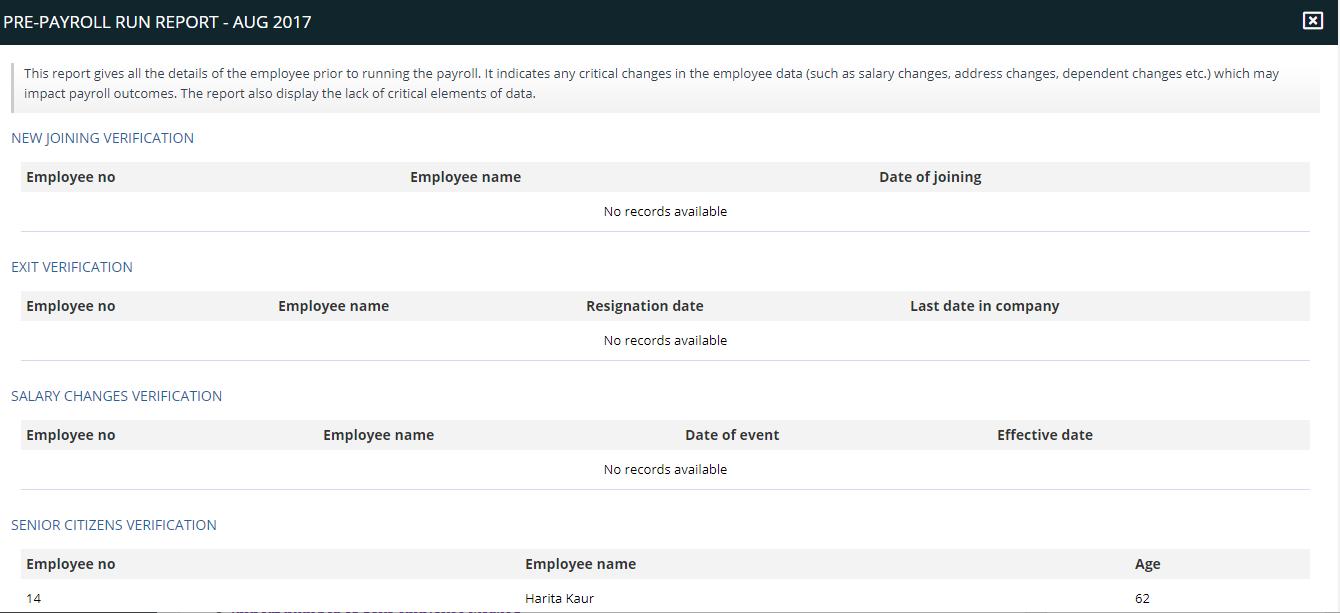

3. The report in web page looks as shown in Figure 3.

Figure 3

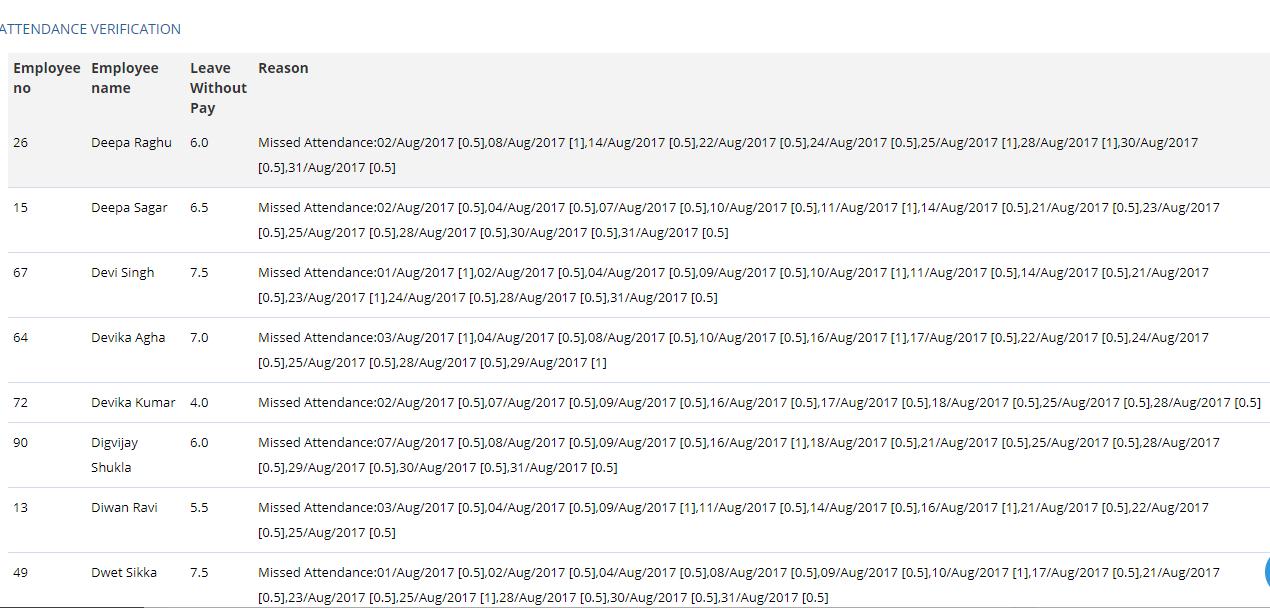

4. Scroll down the report to view the employee attendance status or data availability status of the employees in the report.

Figure 4

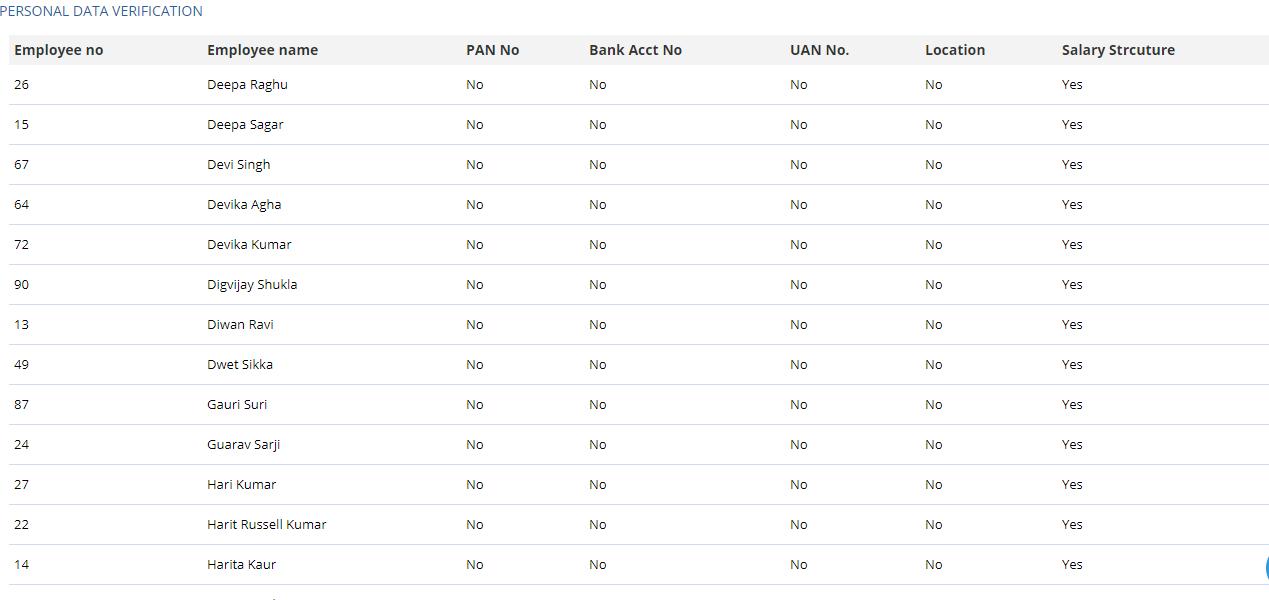

5. View personal data verification section to verify employee details.

Figure 5

Post payroll calculation reports (Final Reports)

Once the payroll is finalized and calculated you may view/download various reports like Bank report, Statutory deduction report, Consolidated payroll report and Variation report.

To view/download these report, select the employees whose payroll for that month is calculated and click on the report button. Following reports are shown on the page that appears.

Figure 6

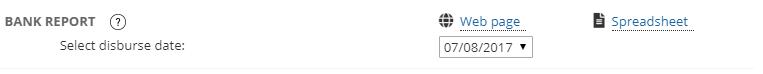

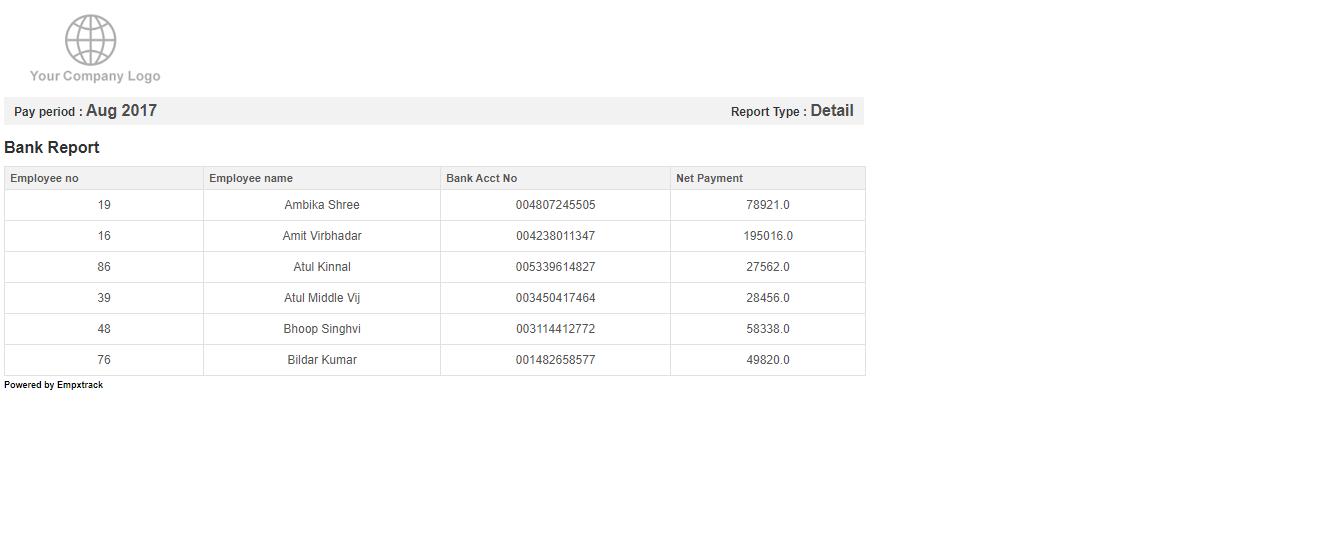

Bank Report: The report contains columns such as employee name, bank account number and amount transferred for submission to the bank.

To view/download this report, specify the disburse date and click on webpage link to view or spreadsheet link to download the spread sheet.

Figure 7

The report looks as shown in Figure 8.

Figure 8

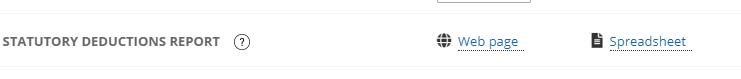

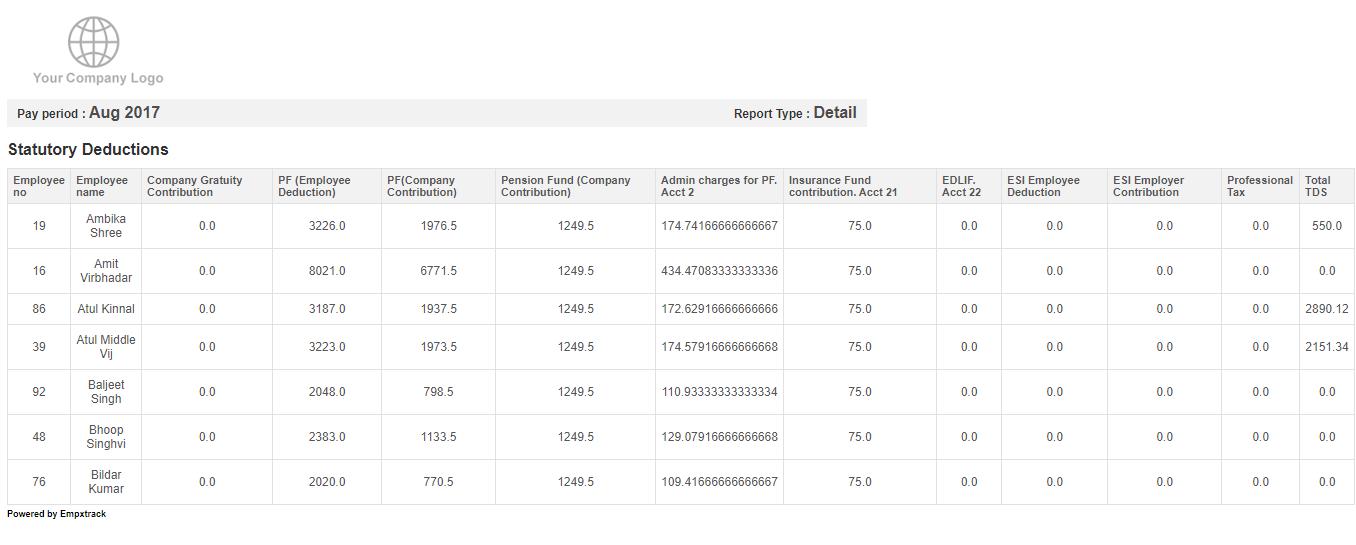

Statutory deduction report: Get a brief on all the statutory deductions like Provident Fund, ESI, TDS, Gratuity and Professional Taxes (PT), employee wise.

To view/download this report, click on webpage link to view or spreadsheet link to download the spread sheet.

Figure 9

The report can be viewed as shown in Figure 10.

Figure 10

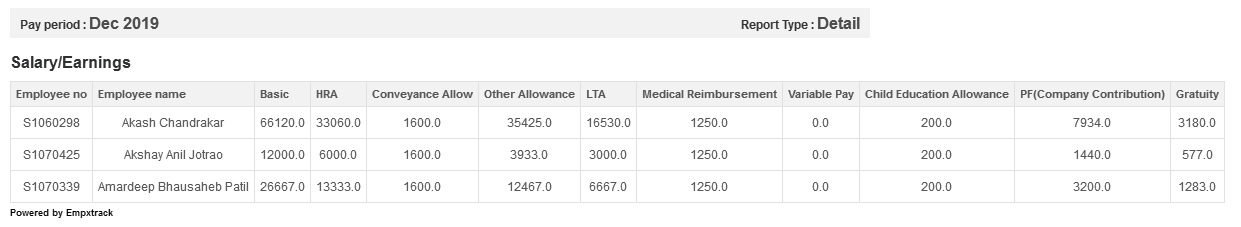

Salary Heads Report

This report contains the details of all the salary heads for the specific payroll. Salary heads are components of employee salary that are not based on monthly variables.

Figure 11

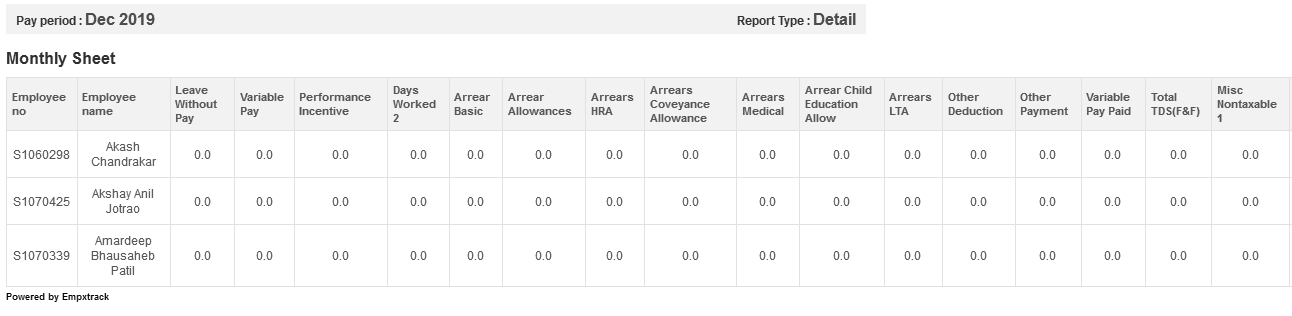

Monthly Heads Report

This report displays details of all monthly heads for the specific payroll pay period. Monthly heads include leave without pay, bonuses, commissions, arrears and other variables that change month to month.

Figure 12

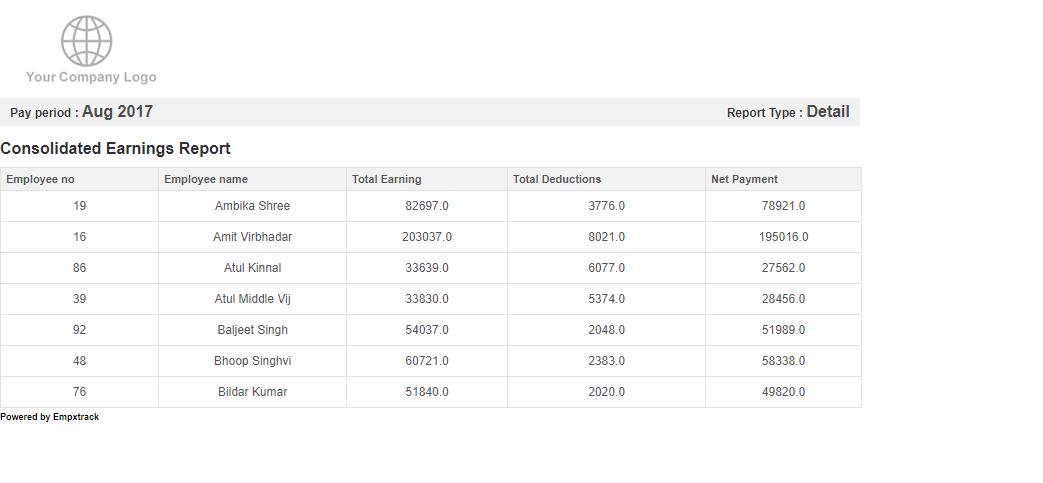

Consolidated report: This report displays details of net payout, monthly variables (Basic, HRA, Special allowance, Conveyance allowance), deductions (PF, ESI, PT, TDS, LWF), extra payments, days worked, arrears for all employees. This is the most comprehensive report and can be used to import data into your financial system.

To view/download this report, click on webpage link to view or spreadsheet link to download the spread sheet.

Figure 13

The report can be viewed as shown below.

Figure 14

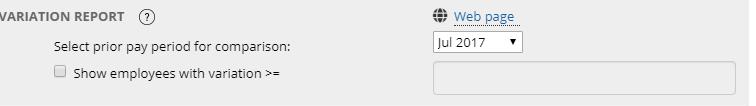

Variation Report: The variation report allows comparison of the existing payroll (Current month) with a prior payroll (Last month) and identify the variations (if any). This is a default audit mechanism and helps you to identify errors.

To view this report, click on webpage as shown below.

Figure 15

The report can be viewed as shown in Figure 16.

Figure 16

Note: Some of the above reports are available only in the Paid version of Empxtrack. Paid version allows you to configure the fields associated with each report. Click here to know steps to upgrade Empxtrack Free Payroll and HR software to the paid version.

To learn steps to download reports, visit the help page Download Payroll Reports.

Learn more about Empxtrack Payroll

Learn more from the suggested links

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll