Configure company settings to setup company details required for statutory reports. This functionality is applicable to Indian companies only. The help page describes how to configure company settings for payroll.

To configure company settings for payroll, you need to:

- Log into the system as HR Admin/ HR Manager.

- On the Dashboards homepage, click Product configurations. In the Payroll Settings section, click Configure Payroll.

- By default, the Global Settings page appears. Click on the Company settings under Payroll Settings.

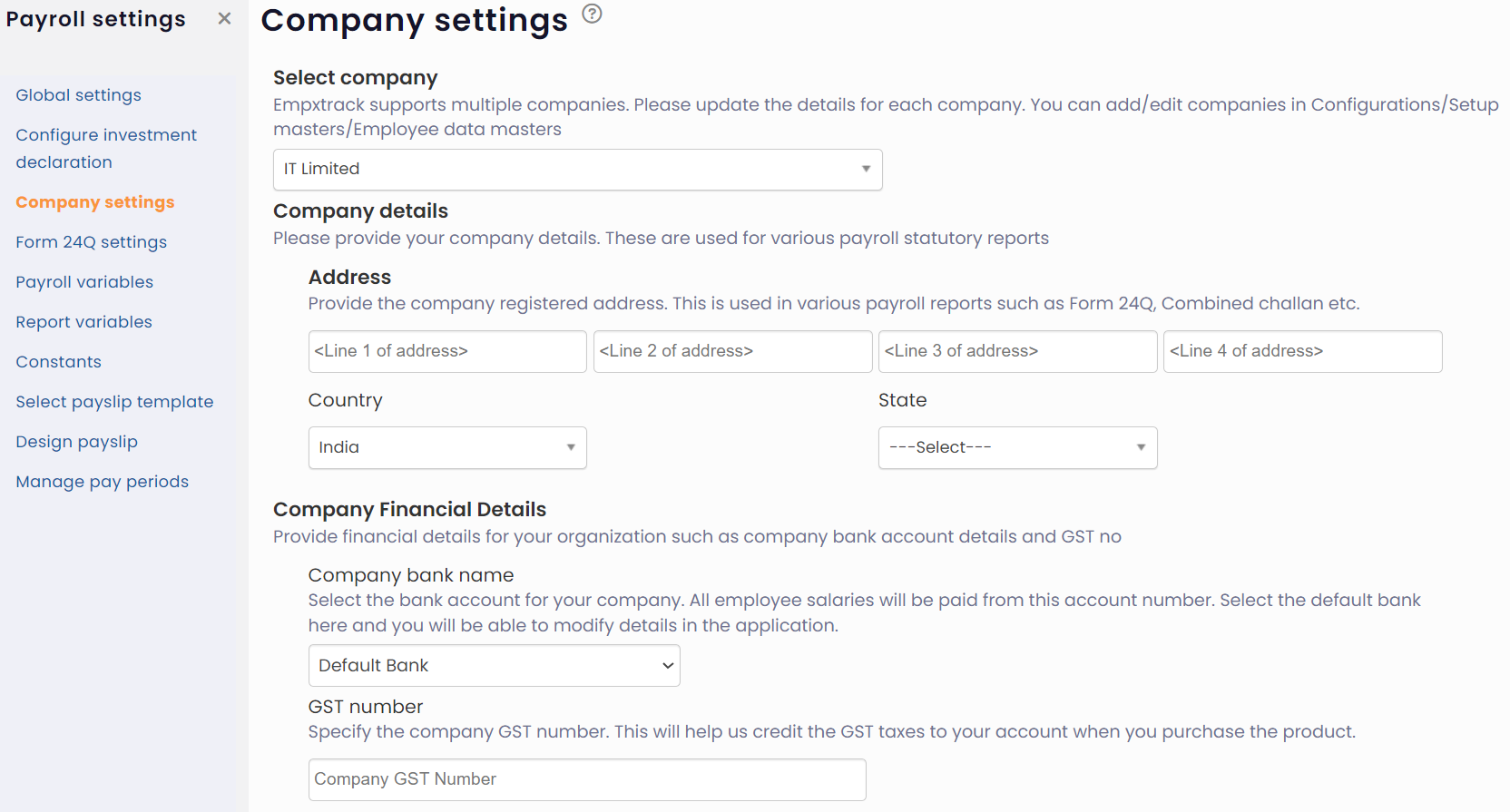

Figure 1

Now the Company Settings page appears where you can setup company information. This information is required for generation of various statutory forms.

- Select the company name from Company dropdown.

- In the Company details section, specify company address in the Address fields. Provide the Country and State and other details, as shown in Figure 1.

- Provide Company financial details to meet compliance. Specify bank account details and GST number. This helps in crediting the GST taxes to the user account when Empxtrack product is purchased.

Note: Empxtrack supports both New and Old tax regimes in its all product versions.

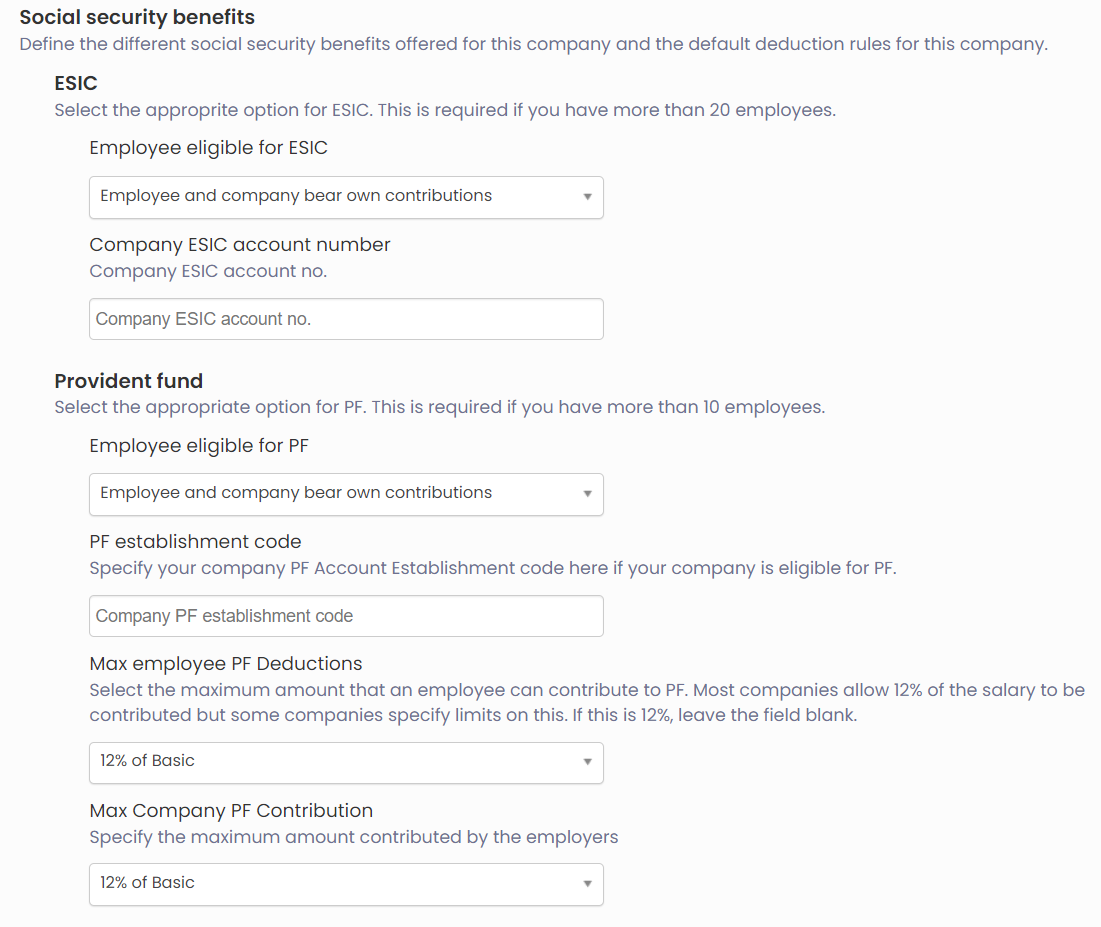

Figure 2

- In the Social security benefits section, select the options for ESI and PF from the respective dropdowns labelled as Employee eligible for ESI and Employee eligible for PF. Provide Company ESIC account number and PF establishment code in the textboxes.

- Set a limit for maximum employee PF deductions and maximum company PF contribution by using the options from the dropdown.

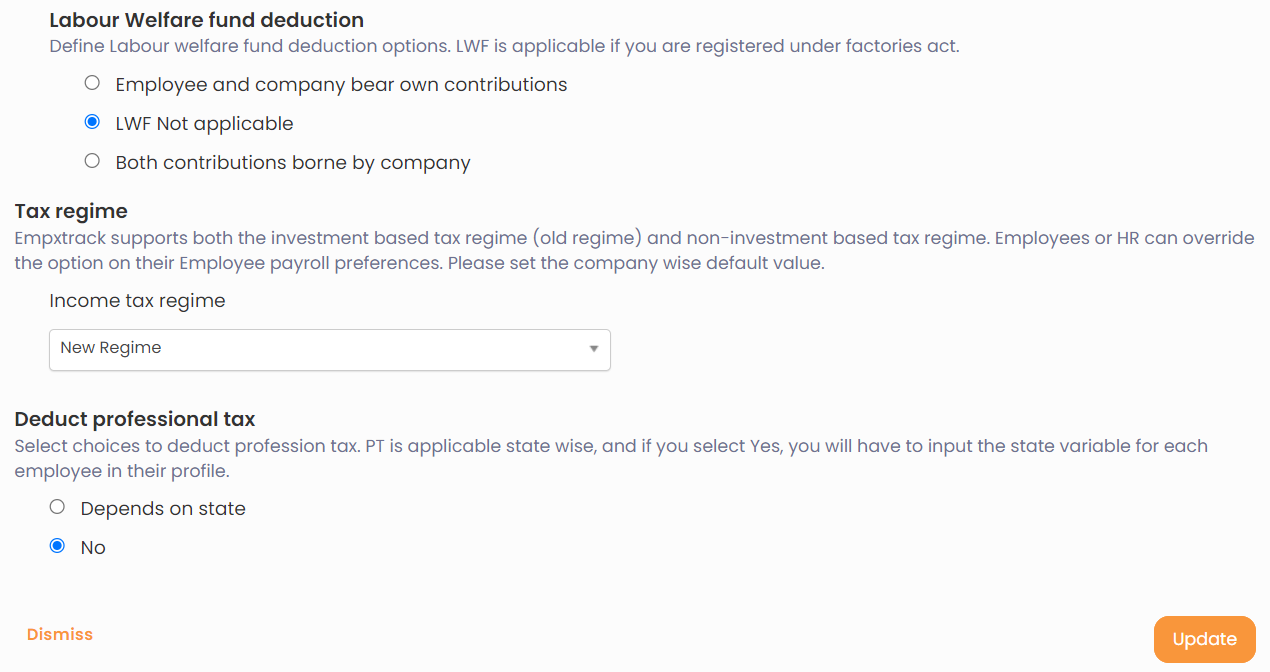

Figure 3

- Define Labour Welfare fund deduction by making the preferred choice from the given options

- Select the preferred tax regime for your employees from the Income tax regime dropdown.

- Click Update. The details of the company are successfully saved and a message suggesting the same appears on the screen.

Learn more about Empxtrack Payroll

Click on the following links to know more about them:

- Payroll Configurations

- Setup Payroll Variables

- Setup Variables for Payroll Reports

- Setup Salary Structures

- Add Salary Heads to a Salary Structure

- Assign a Salary Structure to Employees

- Upload Salary Structure

- Upload Past Salaries for Employee

- Download Employee Salaries

- Setup Investment Declaration

- Design Pay Slip

- Setup Claim Variables