The help page describes how to disburse payroll in Empxtrack. The Disburse Payroll functionality is the final step of salary processing that allows salary distribution to employees. The salary is disbursed only for employees whose salaries have been finalized. Once the salary is disbursed, the employees can view their salary slips.

To disburse the salaries, HR Manager/ HR Admin needs to first follow the steps demonstrated in the links below (step 1 to 5). First follow these steps to reach the stage of salary disbursal.

- Initiate Payroll

- Calculate Payroll

- Submit Payroll for Approval. This step is optional.

- Finalize payroll

- Set Payment Mode. The set payment mode functionality is optional and allows modifying the default payment mode of wire transfer for employees.

- Click Set payment mode and disburse date button. The payment modes selected for employees are modified successfully.

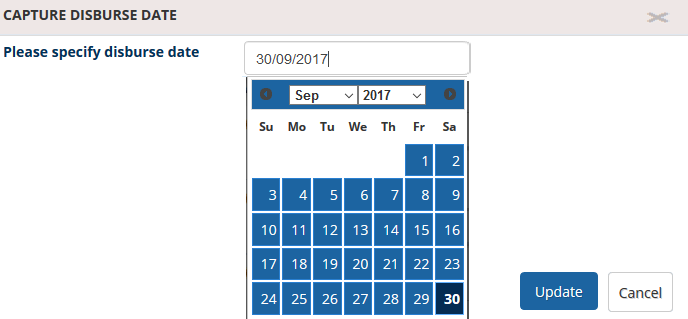

- Specify the disburse date using the integrated calendar option as shown in Figure 1. This step schedules the salary disbursal date for the selected employees on a specific date. Now click Update button.

Figure 1

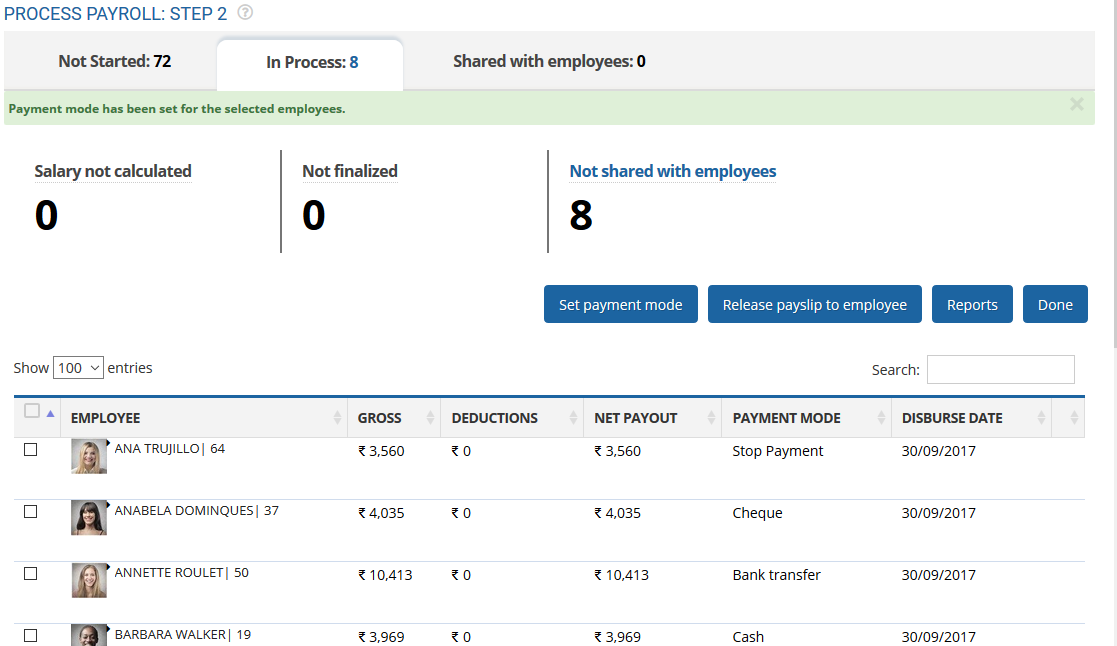

- A message suggesting that the payment mode is saved successfully appears on the screen. The disburse date is displayed in the Disburse date column as shown in Figure 2.

Figure 2

Salary of employees will disburse on the specified date. Once the salaries are distributed, you can release pay slips to employees.

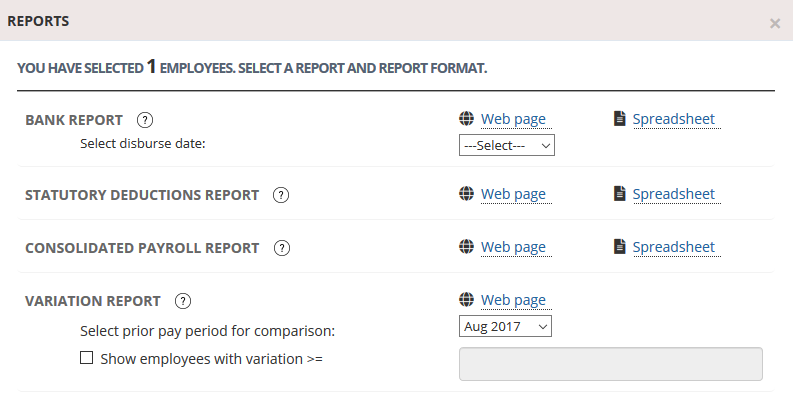

- Select all employees and click Reports to view bank and other payroll reports. Learn more about pre and post payroll reports here.

Figure 3

- Now select employees for whom you wish to release pay slips and click Release payslip to employee button. Now the employees can view their payslips on the portal post salary disbursal.

- The Shared with employees tab displays the records for employees whose salaries have been disbursed. Now you can select them to share their payslips over the email. Select employees and click Share payslips with employees link. Employees can view their salary slips from their login. Learn how employees can view their payslips and salary details.

Click on the following to know more about them

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll