Empxtrack offers more than 15 statutory reports and challans that are required for payroll reporting in India. View and download statutory reports and challans when required.

Note: Empxtrack Free Payroll and HR software offers few statutory reports. Upgrade to a paid version to avail more reports. Watch a short video on how to upgrade Empxtrack Free Payroll software in just a few clicks

To view and download statutory reports and challans, you need to:

1. Login to the system as an HR Manager/ HR Admin.

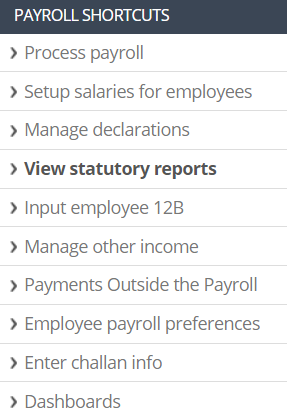

2. On the Homepage, click on the Payroll tab. A new page appears where Process Payroll tab is opened. Under Payroll shortcuts, click View statutory reports tab.

Figure 1

Multiple Statutory Reports and Challans

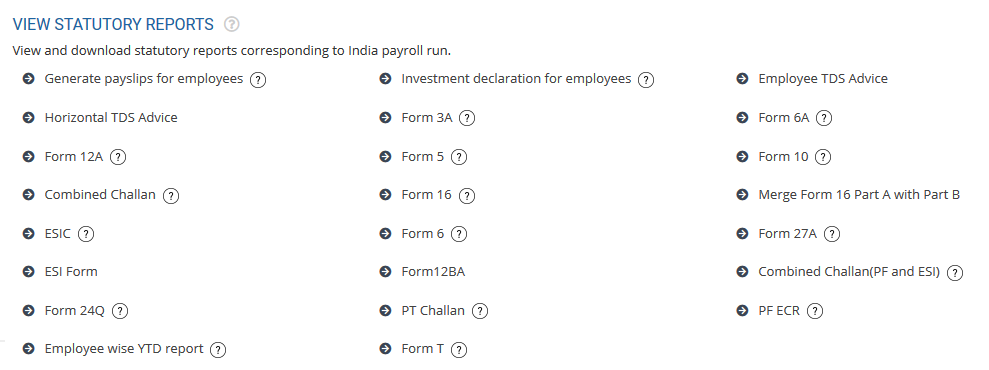

3. A page appears with the list of statutory reports available in the application. A brief description of these reports and challans is given with the tip (question mark) shown against each report (See Figure 2).

Figure 2

Note: Some of these statutory reports and challans are not available in Empxtrack Free Payroll and HR software. Upgrade to a paid version to access all the statutory reports.

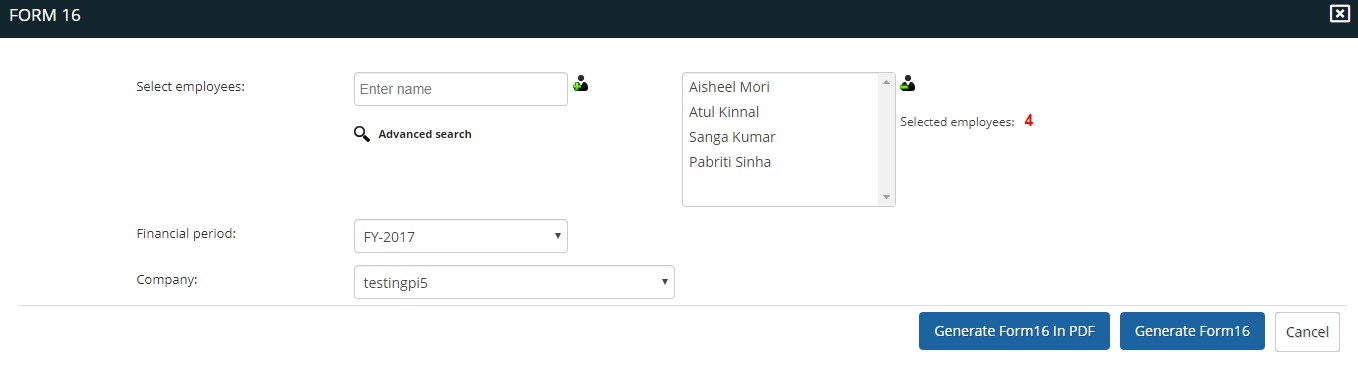

Form 16

4. Click Form 16. A new page appears where you can generate the report as shown in Figure 3.

Form 16 contains tax details that are deducted by the employer on behalf of employee. The same will be paid to government by the company. All tax payers ought to use the Form 16 to file the ITR at the end of the financial year.

Figure 3

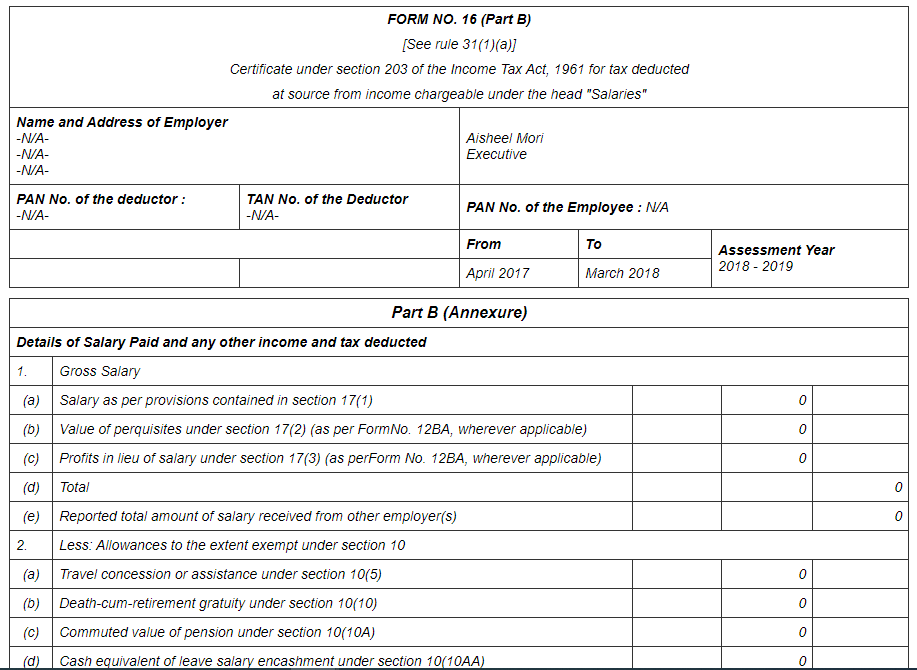

Click Generate Form 16 button to generate the report as shown in Figure 4.

Figure 4

Click Cancel to go back to the statutory reports page and view another report.

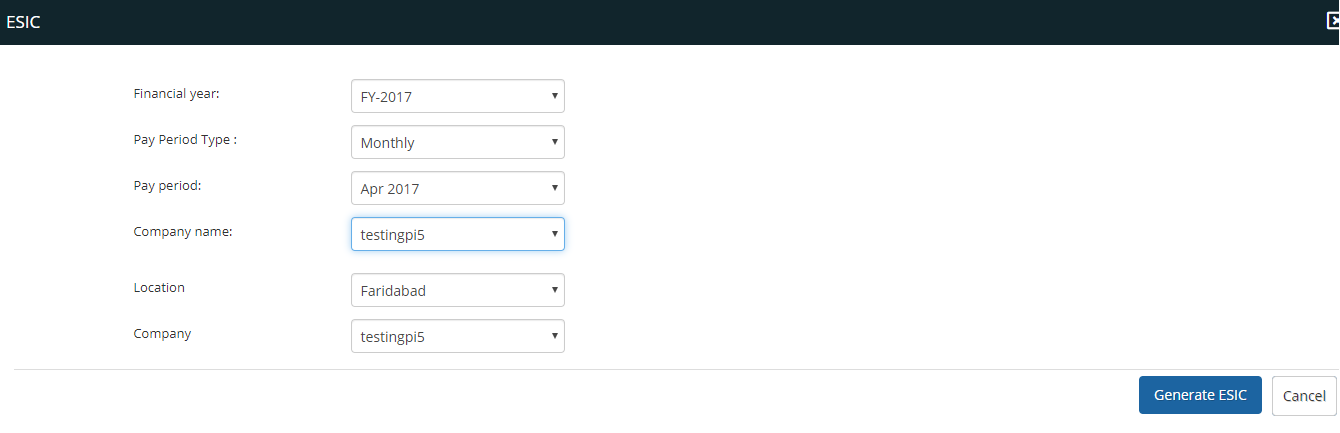

ESIC

5. Click ESIC to view ESIC report. A new page appears asking you to enter financial year, pay period type, pay period and other necessary company details. Click Generate ESIC button.

ESIC is Employees State Insurance Corporation. The benefits offered by the ESIC are in line with the conventions of Conventions of International labor organization. It includes benefits like Medical, Sickness, Disablement Benefits etc.

Figure 5

The report generates successfully to give details of ESIC amount deducted from employees’ salary.

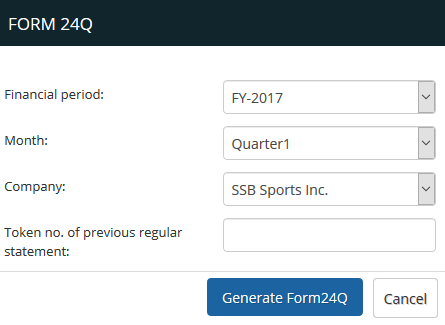

Form 24Q

6. Click Form 24Q to generate the form. A new page appears where you can select the preferred Financial Period, Month and Company Name, and input Token number of previous regular statement. Then click Generate Form 24Q button. Learn how to generate Form 24Q in detail.

Form 24Q is a quarterly statement containing details of the taxable salary of employees and their tax deducted. Each employer is responsible to submit Form 24Q in each Quarter to the Income Tax Department.

Figure 6

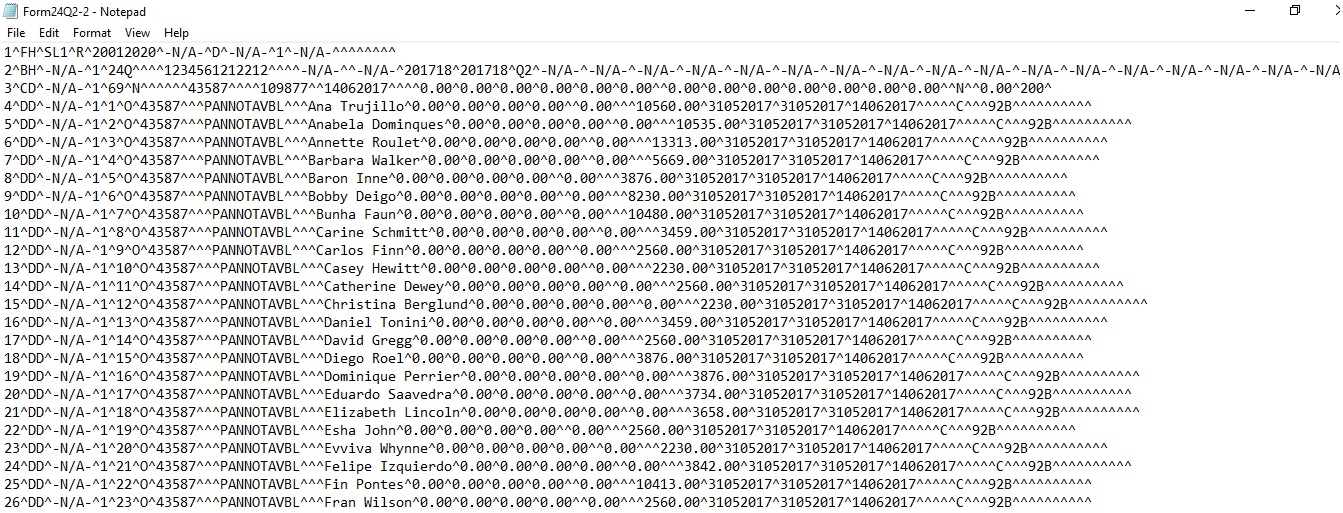

A text file is generated successfully as shown in Figure 7.

Figure 7

To learn more about statutory reports, visit the help page Statutory Reports India.

Learn more about Empxtrack Payroll

Click on the following to know more about them

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- Setup and Upload Monthly Sheet

- Clear Payroll